It was recently announced that Tom Brady had become a minority owner of English soccer club Birmingham City. And he’s not the only celebrity stepping onto the pitch.

Celebs across the board, from athletes to actors, are investing in soccer teams, The Wall Street Journal reported. The famous see it as an opportunity to boost both the value of second- or third-tier clubs and their own brands.

“It’s the most popular sport in the world,” Jordan Gardner, an American soccer investor and a co-owner of the Danish team F.C. Helsingør, told the WSJ. “You’re looking at real serious asset appreciation values, and then also serious, large revenue streams, especially when you get to the top leagues in the countries in Europe.”

Brady is just the latest in a long line of A-listers to throw their support behind European teams: J.J. and Kealia Watt invested in the Premier League’s Burnley Football Club; LeBron James has a minority stake in Liverpool F.C.; and Michael B. Jordan backs A.F.C. Bournemouth. Other celebs are more interested in stateside clubs: Will Ferrell, Mia Hamm, and Magic Johnson are all part-owners of Los Angeles F.C., while a group led by Natalie Portman started Angel City F.C. back in 2020.

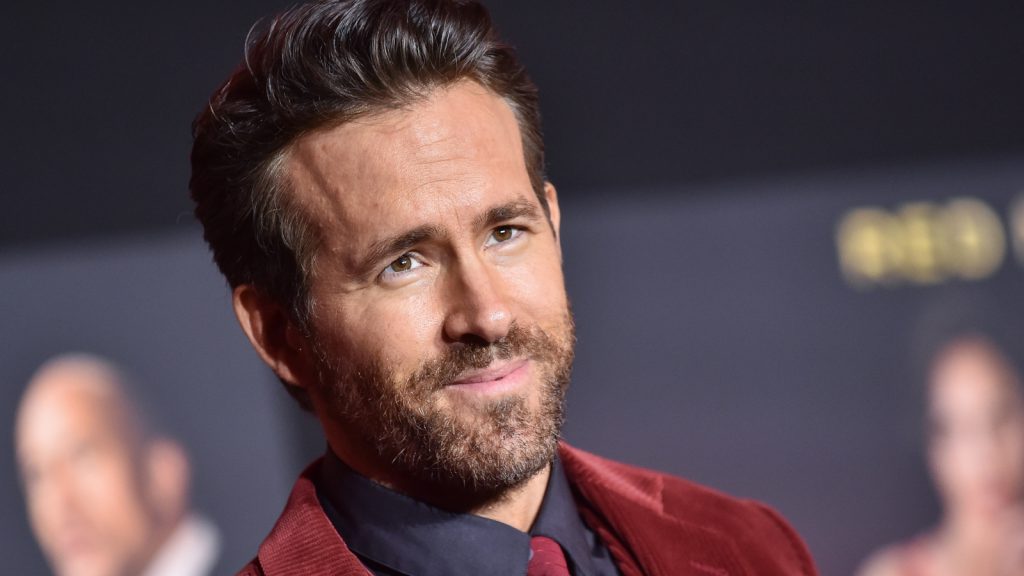

All of these stars have money in the game, but the intensity of their involvement varies. Some may be passive investors, while others take a stronger role in the day-to-day operations of their club. For example, Brady will be the chairman of Birmingham City’s advisory board, and he’ll work alongside the sports science department on health and wellness programs. Elsewhere, Ryan Reynolds and Rob McElhenney, who own Wrexham A.F.C., pushed that team into the spotlight via a docuseries and partnerships with companies like TikTok and Expedia.

Those sorts of deals might be lucrative for the team, but celeb investors don’t always see a huge deal of money right away. That’s not the goal for many of them, though.

“They’re not investing to make money on a day-to-day basis. These are not highly profitable businesses,” John Mullins, an associate professor of management practice at London Business School, told the WSJ. “But they think it’s going to be worth tomorrow way more than it’s worth today.”

Having an A-list name attached to your club increases the cool factor, at least.

Previously published on Robb Report.

Photos: Shutterstock